- Replies 25

- Views 1.9k

- Created

- Last Reply

Most active in this topic

-

Psamsara 10 posts

-

Colnago 5 posts

-

Timillustrator 3 posts

-

Blackpoolsoul 3 posts

Most Popular Posts

-

You can’t claim vat back on a record, unless you were a record dealer buying from another record dealer and both of them vat registered . I would have thought.

-

Vat, especially x-border (within country v within EU v outside Eu...) vat is very complex and an awful lot of businesses dont understand it properly and neither do some of their accountants ! this is

-

Nah , you can’t be vat Registered in the uk and just knock the vat off , they must have given you some discount but you can’t just knock vat off , unless there is some special exemption with the count

Ok, so the thing is that i'm from Serbia and we are still not in EU, so i have no obligations in paying VAT.

Not sure how much is it, but it's about 18%. Obviously it can be a nice sum for something expensive... little compensation for a country where average pay is 350 euros.

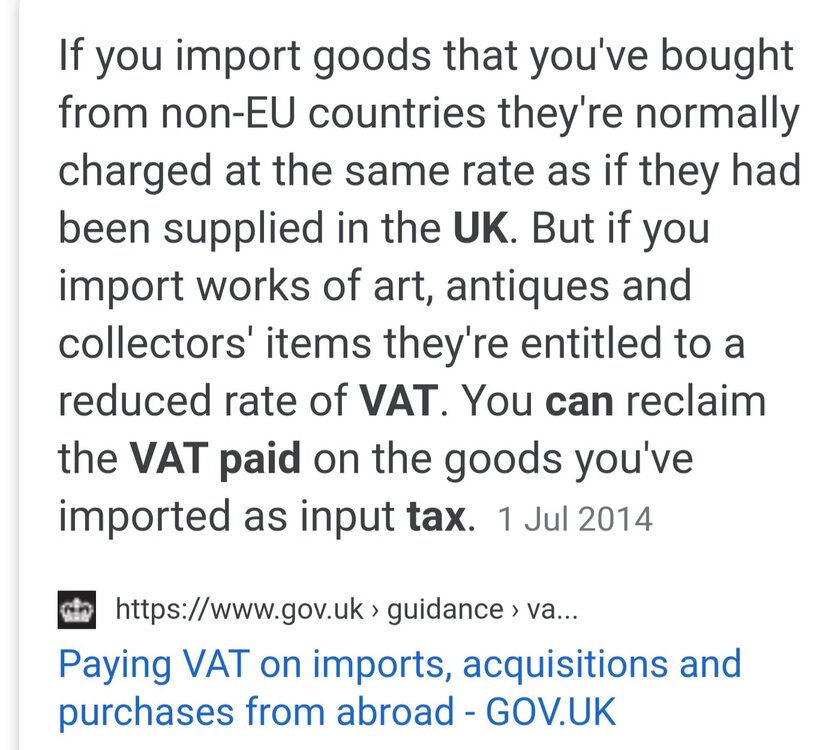

I have receipts from Hard to find records, where i was buying long time ago, and it's a sum. They told me that they don't refund VAT and that there is no VAT reclaimable on second hand goods, which is not true as far as i know.

Certain someone who sells on ebay, as well on his own site, told me: "vat is not a factor its part of the price we dont add it", even though on checkout on his site it showed and deducted VAT, but fail to do it on final step. From my own experience this is due to some technical issues, and i had many troubles when i started buying records, as many sites didn't even have Serbia among countries to choose from. On his ebay listing this is what stands bellow: Value Added Tax Number

So i don't understand.

Juno is automatically removing VAT for me... crazybeat records as well, and they are selling used stuff. Vinyl Underground did the same thing.

Would like to hear if someone knows something on this subject, as i really feel i shouldn't be paying for this